What Is A Trading Style

Contents:

Indeed, if you have a personality style conducive to trading in the short term, you may prefer it. You may be the kind of person who is easily bored and craves excitement. Short-term trading is much more exciting than long-term investing. One of the most common methods of scalping is buying at the Bid price and selling at the Ask price and making a quick profit out of the difference between the Bid/Ask price. They hold positions only for a short duration, and as such, the chances of suffering huge losses from wide and sharp fluctuations in prices are remote. Swing trading refers to the style of trading leaning more towards fundamental trading, where positions are opened and kept open for a period of days or weeks.

How to Set Entry & Exit Strategies in Trading – MinuteHack

How to Set Entry & Exit Strategies in Trading.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

In this article, we’ll explain what day trading is and show you some popular techniques to day-trade the market. However, before we dig deeper into day trading, let’s quickly cover the main trading styles that traders use to trade financial markets. Position trades require in-depth knowledge of the companies you trade. Some day traders get away with only using technical analysis. For swing trading, it’s good to know both technical and fundamental analysis. For the long-term trader who likes to hold positions open ranging from months to years.

HFT involves the use of advanced technological https://forexarena.net/ and computer systems to enter and exit trades in the markets within seconds or fractions of a second. HFT traders do their best to ensure low latency to the exchange’s or broker’s server to take advantage of maximal order speed execution necessary for this trading style. In finance and economics, a technical director is a professional who provides technical analysis and guidance to investors. Technical directors use their knowledge of market trends, technical indicators, and financial analysis to make investment decisions. They may also provide guidance on portfolio management and risk management. The difference between these different types of traders is their stock market trading style.

This style takes on overnight risk exposure so the share size allocation must be less. When you understand the various different trading styles, you can try each of them of them out on one of our risk-free demo accounts to understand which style you prefer. Get the best educational information to build your market knowledge as well as the best 24 /5 support to back it up. We offer you many free trading tools, so that when you enter the market, you will do so in confidence. These are trading styles that are largely different variations of automated trading. Automated trading is simply automating manual trades, making them executable by computer software, without human intervention.

Support

The beginner may benefit from some https://trading-market.org/-term, very low-risk trading activity to gain understanding of the various trading concepts and tools of technical analysis. But, as soon as he’s willing to embark on serious activity, he’d be well-advised to focus on trading psychology, rather than trading style. Developing a well-balanced trading strategy requires investors to determine the potential added value to the portfolio. Financial instruments are diverse in terms of trading complexity, risks, and the liquidity they offer. Perhaps the biggest decision a trader must make is deciding between long-term investing and short-term trading. In his book, “Trade Your Way to Financial Freedom,” Dr Van K. Tharp outlines the advantages and disadvantages of each approach.

Short sellers sell borrowed shares when a price is high hoping it will fall. When a stock breaks through a key level, it moves with conviction. These are the kinds of trading setups that can keep you coming back for more. If a market-disrupting event happens after hours, your money should be safe.

Experimenting With Style(s)

Scalping ; Scalping is a method to making dozens or hundreds of trades per day, to get a small profit from each trade by exploiting the bid/ask spread. A long short strategy consists of selecting a universe of equities and ranking them according to a combined alpha factor. Given the rankings we long the top percentile and short the bottom percentile of securities once every rebalancing period.

It might just involve saying that when the market hits X price, you’ll enter your trade, and when it hits Y, you’ll close it. Or, it could involve a more complex system of technical indicators that generate trading signals for you to use. A trading strategy is a set plan that is designed to help you achieve consistent, profitable returns.

Position trading

You don’t want to take negative emotions from a losing trade into your next trade. We recommend you to visit our trading for beginners section for more articles on how to trade Forex and CFDs. In order to register a trade name in Washington state, you must first file a Trade Name Registration form with the Washington Secretary of State. After you have filed the form, you will need to pay a filing fee of $5. Once your trade name has been registered, you will need to renew it every two years.

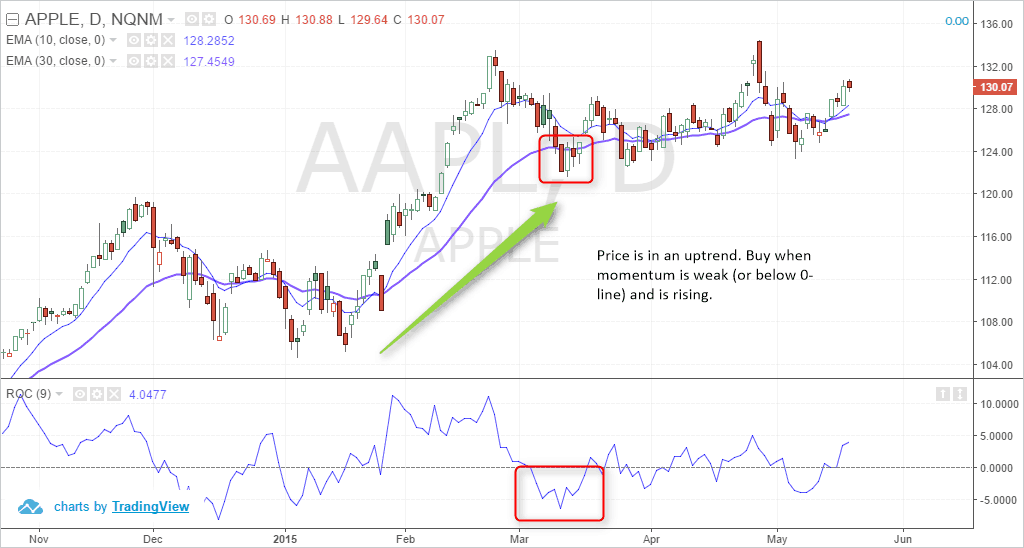

Range traders will also use tools, such as the Bollinger band or fractals indicators, to identify when the market price might break from this range – indicating it is time to close the position. Some of the most popular technical analysis tools included in trend-following strategies include moving averages, the relative strength index and the average directional index . Although there is a lot of confusion between ‘style’ and ‘strategy’, there are some important differences that every trader should know. One of the biggest mistakes that beginner traders often make is to change trading styles at the first sign of trouble. What typically separates the trading styles is the length of time you intend to be in a trade, the timing of your entry, and in some cases, the frequency of the trades. One of the biggest mistakes that new traders make is to change trading styles at the first sign of trouble.

- The good news is you likely won’t lose more capital than you put into a trade (unless you use leverage, which I don’t recommend).

- It’s less stressful and you don’t need much screen time because you are trading off the higher time frames.

- This isn’t a rain man moment where the inconspicuous savant discovers his abilities nor will you find participant trophies here – expect nothing from a ruthless and predatory market such as crypto.

- Tactical trading is a style of investing for the relatively short term based on anticipated market trends.

If you were going to take a short position, you’d do so if you thought the market would reach lower lows. As some of these styles require traders to have extremely fast reactions, there has been a growing interest in high-frequency trading . This is an algorithmic method of trading that large organizations use to execute a huge number of orders in a matter of seconds. Trading styles can be molded to fit a trader’s time restrictions, profit goals, and personal strengths. Choosing a trading style requires the flexibility to know when a trading style is not working for you. It also requires the consistency to stick with the right style, even when its performance lags.

If you have a busy lifestyle this may be a suitable method because it requires less time in front of the screen to analyse or manage the trade. There are no strict rules as to which timeframes a particular trader would use to trade, however the table below provides typical timeframes you would expect to see a trader using. Harness past market data to forecast price direction and anticipate market moves. A downtrend is an overall move lower in price, created by lowers lows and lower high. A downtrend describes the price movement of a financial asset when the overall direction is downward.

You have to be willing to leave your trade alone for a while. Trading styles are one of the most important factors in your overall market strategy. SpeedTrader provides information about, or links to websites of, third party providers of research, tools and information that may be of interest or use to the reader.

What Is a Trading Strategy?

The process of borrowing shares is done electronically through the broker. Brokers usually provide a daily updated list of stocks available to short. Broker platforms will also typically warn when specific shares are not available for shorting. Most traders and investors are more familiar with long trades, utilizing the “buy low, sell high” mentality. This type of trading is relatively straightforward and can be done with most trading accounts. The aim of a strategy is to find the most advantageous points to enter and exit your trades.

- Thus, selecting a viable combination of financial instruments is a prerequisite for an optimal portfolio.

- You may be the kind of person who is easily bored and craves excitement.

- Remember, you don’t own the shares you short — you borrow them.

- However, day trading is among the most exciting strategies when buying and selling securities.

Please ensure you fully https://forexaggregator.com/ the risks involved by reading our full risk warning. There is a third type of trading strategy that has gained prominence in recent times. A quantitative trading strategy is similar to technical trading in that it uses information relating to the stock to arrive at a purchase or sale decision. However, the matrix of factors that it takes into account to arrive at a purchase or sale decision is considerably larger compared to technical analysis. A quantitative trader uses several data points—regression analysis of trading ratios, technical data, price—to exploit inefficiencies in the market and conduct quick trades using technology.

Successful traders develop their trading styles in order to specialize and gain expertise. While Rodman was a subpar offensive player, he excelled as a rebounder and defender and was thus a key contributor on many championship teams. Just as you will do in developing your trading style, Rodman focused on his strengths instead of trying to blindly mimic others. Depending on your personal preferences, there are four main trading styles which can be used to trade the Forex market. Short selling is a high-risk strategy with the potential for high reward. The danger with short selling comes when a position goes up instead of down.

No Comments